Running a restaurant can be easily termed as a Herculean task, especially in a pandemic. With new restaurants struggling to break even and established ones working on negligible profits, it takes more than just a quality dine-in experience to survive these tough times. But even before the pandemic, a lot of restaurants faced challenges surviving in this industry with cut-throat competition.

With the local government relaxing restrictions on restaurant operating time, owners can finally breathe a sigh of relief. But to prepare your restaurant for the customers requires more than just advanced sanitization features. You need to ensure you are better prepared to earn more profits in order to make up for the losses incurred in the past year.

A great way to survive AND thrive is to keep a check on your expenses. While many feel ignoring small expenses doesn’t really lead to a huge difference, the reality is quite the opposite. An accumulation of multiple unnecessary small expenses can burn a hole in your pocket and deplete earnings quicker than you think.

A classic example would be the poor pricing of the menu. Consider that you have started a restaurant in a highly popular location and kept your menu prices low to beat the competition. But this makes your profit margins thinner than ever. The vice versa can also be disastrous because an overly priced menu can reduce your footfall.

So where do we start? The first step is understanding the money that flows in and out of your establishment. When you become aware of every small debit, it becomes easy to understand how to reduce costs and increase profit margins. One of the most significant expenses that you can monitor and reduce for earning more profits is COGS.

What is COGS for a restaurant?

Cost of Goods Sold, or simply COGS, refers to the actual cost incurred in making the food and beverages sold by your restaurant in any given time frame. This is one line item that’s typically 25-40% of your sales and is directly proportional. Although this is the average COGS for a restaurant, being in the higher 30s is highly dangerous (unless the menu is designed to cost this high) to your restaurant’s financial performance.

While COGS and food cost both help in determining the price of a menu item, COGS is also valuable in deriving the gross profit and EBITDA. This helps in understanding the restaurant’s current operating profits and gives a clear view of your earnings. Even a slight reduction in COGS will help in increasing profits significantly.

For example, if you serve a Penne Arrabiata Pasta in your restaurant, the COGS will include the raw pasta, oils, vegetables, sauces, cheese, spices, and the labor associated with cooking the dish. It is important to note that COGS does not include utilities like cooking gas as it is an expense nor the kitchen set up as it is a fixed asset.

COGS is directly linked to inventory management as it requires a precise measure of every ingredient being used to create a menu item. Thankfully, with a top-notch restaurant management software like EagleOwl, you can effortlessly input your recipe and the quantity of an ingredient being used to generate the exact COGS (theoretical).

Importance of COGS?

As a restaurant owner, you need to be on top of everything to be able to get the desired financial results. Skipping any step can lead to an unpleasant customer experience which in turn can hamper the restaurant’s reputation.

Customers walk into a restaurant to pay for an experience. There are numerous things that contribute to a satisfactory customer experience. You can work on improving the quality of food being served and train your staff to make sure they offer excellent customer service.

But even if you ensure a customer has a positive experience while dining at your restaurant, a poorly priced menu can be off-putting. Most restaurant owners price their menu based on their intuition about the food cost or how their peers and competitors have done it.

Unfortunately, this is highly detrimental to the restaurant’s financial health. The menu pricing can be done based on the desired profit margins. Your restaurant’s Chart of Accounts (CoA) is helpful in understanding these profit margins.

By fixing the food cost percentage, you can plan the menu based on the recipe cost multiples. For instance, consider Windmills Craftworks’s budgeted food cost is 25-26%. So they do a 3.75x to 4X multiple of their recipe cost price to get the menu pricing.

Calculating the restaurant Cost of Goods Sold is paramount to understand how much you end up investing while creating a particular menu item. This not only leads to effective pricing of the menu but also allows you to lower your Cost of Goods Sold.

Being a key metric in determining gross profit, restaurants must strive to keep a clear understanding of their COGS. And since it is inversely proportional to your net income, it is crucial to keep finding ways to lower the COGS.

How to calculate COGS for a restaurant?

The average restaurant COGS varies for all restaurants based on the cost of ingredients and the size of the business. But in any scenario, it is not possible to calculate COGS for every single menu item. This is why it is recommended to use inventory management software to automate the process and easily arrive at the restaurant’s COGS.

Within the software, you will be required to input the opening and closing inventory count to calculate COGS. In addition to this, the recipe of every menu item needs to be updated to get the final value for a stipulated period.

Note that recipe costing is required to obtain theoretical or expected COGS and generate variance reports. You don’t need this for measuring Actual COGS. But yes, since you need to add finished or semi-finished goods to your opening and closing inventory, if you don’t have the recipes, your costing will be inaccurate.

To calculate COGS, start with taking opening stock at the beginning of the inventory period. Post that, everything that we have ordered or received to be included in the inventory needs to be taken into account. And finally, we need the closing inventory numbers. All these numbers are used in the following formula to arrive at the COGS:

COGS = Opening Stock Value + Purchases – Closing Stock Value

COGS(%) = COGS/Sales

Let’s take an example to understand this further. The restaurant starts with an inventory of INR 80,000 for the month of July 2021. It then purchases additional inventory throughout the month that adds up to INR 15,000. By the end of July, their closing inventory is INR 45,000.

Using the restaurant COGS formula stated above, we perform 80,000 + 15,000 – 45,000 to get INR 50,000 as the COGS for the month of July 2021. The restaurant COGS percentage can then be easily determined by calculating 50,000/Sales. Having this information can allow the restaurant owner to determine their gross profit for the month.

Revenue/Income (-) COGS = Gross profit

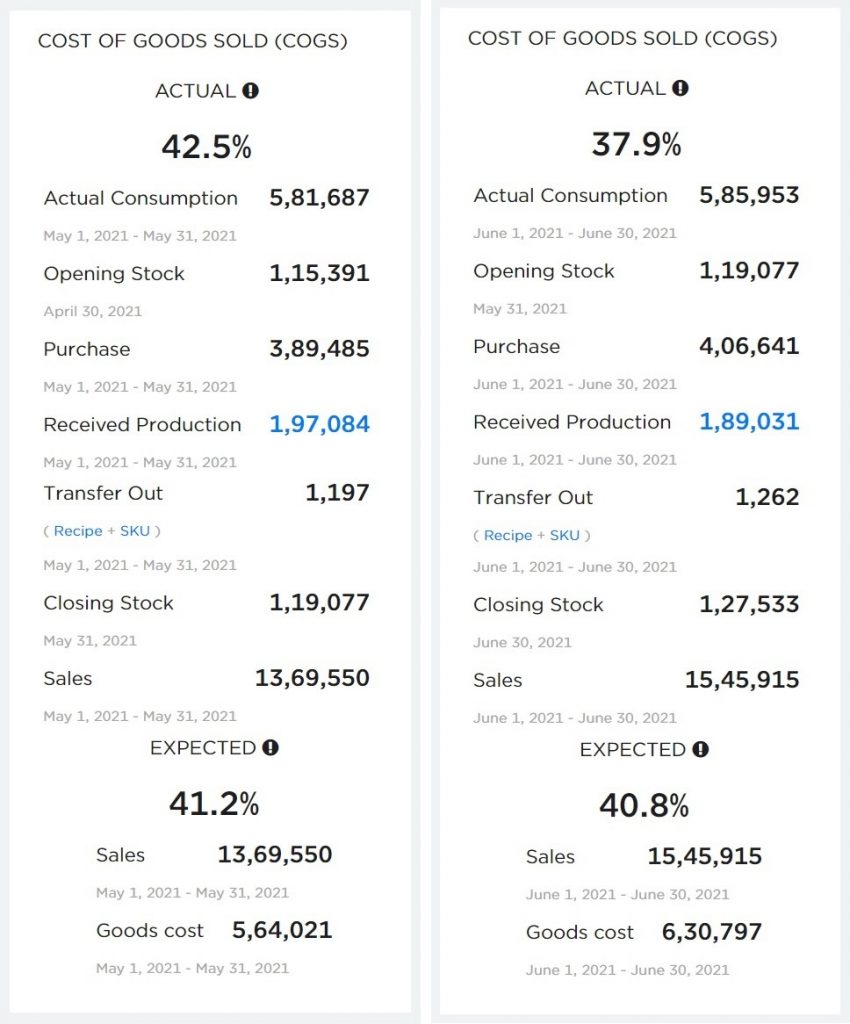

Let’s take a real-life example of a restaurant in Bengaluru, India that started working with us to understand and lower their COGS. We started with an accurate inventory-taking process to get the opening & closing inventory for the month of May 2021 and derive COGS.

As seen in the images below, the COGS reduced from 42.5% to 37.9% which is a tremendous improvement. At the same time, there is an increase in sales but the consumption remains low leading to higher profit margins.

Had the COGS remained constant even in the month of June 2021, the actual consumption would have been 6.57lacs as opposed to the recorded 5.85lacs. It is important to note that the closer the actual COGS is to the expected COGS, the better.

The discrepancy between the expected consumption and actual consumption in a given time frame is termed variance. Unrecorded sales, food waste, theft, pilferage, purchase fraud, incorrect ideal food cost, over-portioning, and other such factors can lead to variance.

For instance, let’s assume a restaurant only sells coffee. Say each coffee contains 100 ml of milk and 20 ml of decoction. For a sale of 20,000 coffees in a month, the expected consumption is 2000 liters of milk. But say, the actual consumption of milk calculated at the end of the month comes up to 2500 litres. This difference of -500 litres is called variance.

It can be tackled by closely monitoring the inventory. By taking frequent opening & closing stock you can reduce this gap. Even a small reduction in this gap can prove to be beneficial in reducing COGS and help in increasing the restaurant’s financial gains.

A relatable example of this would be Brew & Barbeque who managed to lower COGS significantly by monitoring variance. By increasing the frequency of stock-taking, they were able to find a point of concern in the variance report. On correction, it brought COGS closer to the expected percentage.

Here’s a short video of the EagleOwl software that helps in understanding COGS and shows a comparison with the expected COGS for the month.

How to reduce COGS in a restaurant?

Now that we know how important it is to be aware of restaurant COGS, let’s look at some tried and tested tips on how to reduce & control COGS in a restaurant.

- Automate inventory management:

Calculating COGS manually is time-consuming and prone to human errors. This brings to light the need to reduce manual errors in inventory measurement. You can easily find softwares that fit your budget to automate this process. Such a software can make it easy to manage and keep a check on the gains or losses being incurred by the restaurant.

- Keep reinventing the menu:

Ingredient costs vary from time to time, especially seasonal ingredients. But this can be changed with smart and optimized menu engineering. By highlighting items with higher profit margins, you can balance the COGS on a menu item that proves to be expensive in a certain phase.

- Closely monitor food waste:

Most restaurants struggle with keeping their food waste percentage low. Even though it is uncertain and varies due to multiple factors, analyzing weekly food waste can make way for understanding what items are consistently getting wasted. It also presents the opportunity to get creative about reusing stuff that is close to expiring.

- Purchase supplies in bulk:

While this may not apply to smaller restaurants, it is a great way to reduce food costs. As long as you have clean and hygienic storage space, buying supplies in bulk can prove to be highly profitable. Make sure you have a fair idea about your monthly or quarterly consumption of an item before you go ahead and purchase high quantities of it.

- Find vendors with better pricing:

A quick way to reduce COGS is to find a vendor who can offer you a better deal without reducing the quality of raw materials. Compromising on quality is never the right solution when you want to build a reputation for your restaurant. Instead, talk to new vendors to compare prices and talk to your current vendor to see if they can match those prices.

- Replace items with cheaper options wherever possible:

Now we know we just mentioned not to compromise on quality in the above point, but this is an exception for those few items that can be found at cheaper prices by ignoring brand names. For instance, a condiment manufactured by a big brand can be substituted by one made by a local producer if there is no change in flavor and quality.

Conclusion:

It goes without saying that a restaurant with higher COGS will have to keep the menu prices high to compensate for their expenses and overheads. So it becomes a huge financial risk to not be aware of your restaurant COGS. In the long term, it can scrape away your earnings as well as your profits. This makes it vital to keep examining it for avoiding losses. Do you own a restaurant? Which of the above methods have you used in your restaurant for controlling food costs? Let us know in the comments below!

What you see is not what we see. EagleOwl’s platform provides data driven insights with razor sharp focus on improving your bottom-line and back office efficiency. We use a bit of science, technology and more of common sense which will allow you to increase your net profit by up to 25%.