Sprig, Munchery, Spoonrocket, Maple. Sounds familiar? These are some of the well-known cloud kitchen brands out of USA, years of operation and funding raised.

Sprig – 2013-17, $56.7M

Munchery – 2010 – 19, $125M

Maple – 2015-17, $26M

Maple’s food cost was 63% of revenue in 2015, wonder how the future food cost projections could be in the range of 22-17%. They also spent 17% of revenue on marketing, 26% of revenue was just food waste. Munchery and Sprig also faced similar issues, though official numbers are not found online. According to this report, 16% of prepared food was wasted by Munchery.

Following the trend and rapid capital infusion in food tech startups in US, 2014-2015 saw many similar startups opening in India. Yumist, iTiffin, RedCooker, EazyMeals, ZuperMeal, InnerChef, FreshMenu, etc. We also saw delivery only players coming into the ring. Right from gourmet food to mother’s recipes, each startup vying for a share in a burgeoning market. Many of them are not in the market anymore.

The fundamental premise of operating a cloud kitchen was that it was more profitable. Following were the main reasons.

- Lower rent

- No FOH spend (Front of House)

- Lower upfront capital to start

While all of the above is true, there are several other heads of expenses that come into play, which are largely ignored or swept under the carpet. A typical dine-in restaurant makes about 10-15% EBITDA, or rather used to. Arguments favouring cloud was that one will save labour and rental costs and make more margin, say 15-20% EBITDA.

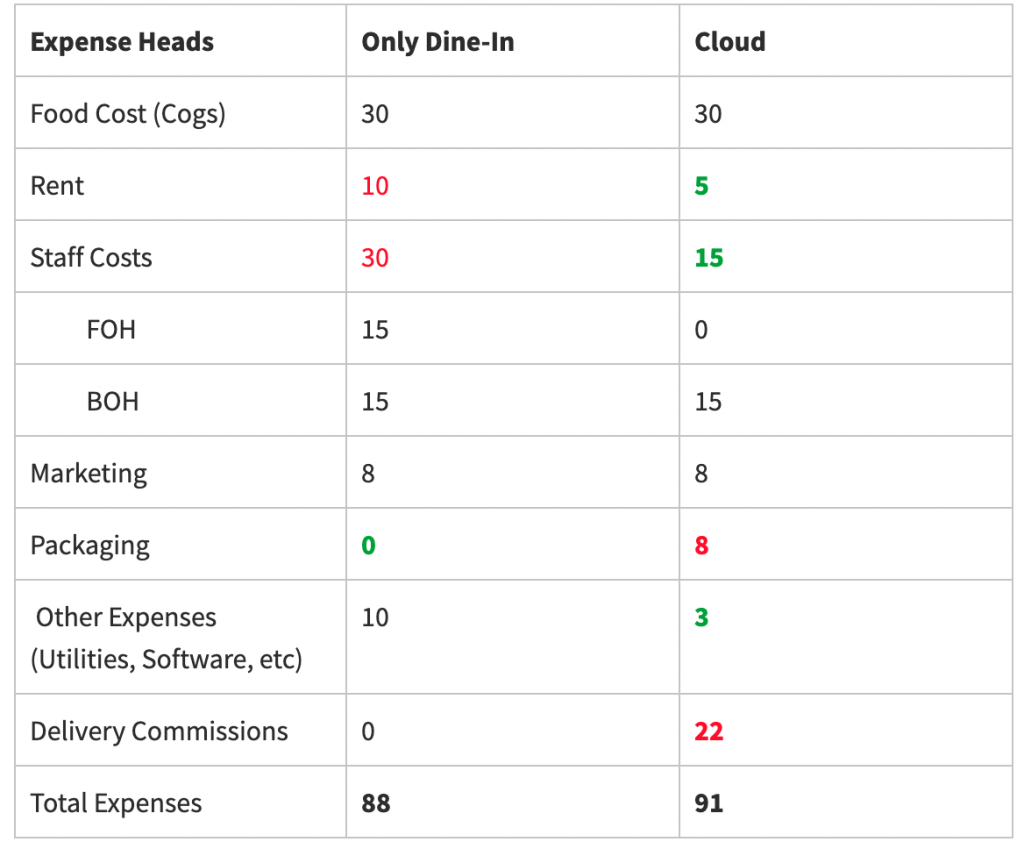

Expense breakdown:

Following are some of the basic costs one would incur on running any restaurant. The breakdown is in percentages. *Tweak as per your actuals/budget allocation.

As you can see, the savings in rentals and labour cost will be undone by expenses on commissions and packaging. Also, I have kept the marketing cost same, however in reality, your marketing expense is likely to be higher if you are purely on the cloud. To get noticed, particularly if you are a new and unknown brand, you will need to take up prime slots in third-party aggregators website. It could be a standard fee per month or pay per click model. Also, I have reduced the expenses on other expenses, 10 vs 3, which may or may not be the reality.

Recently, we spoke to Ajay Nagarajan, CEO of Total Environment Hospitality which runs the iconic Windmills Craftworks brewery and Oota, high-end authentic Karnataka cuisine in Whitefield. For 8 years they were a pure dine-in setup. Recently, they opened a couple of cloud kitchens for Oota, partnering with Kitchens@, a cloud kitchen infrastructure and tech provider.

Ajay quipped, “The infra they provide is awesome, you can just walk-in, no upfront cost and it is revenue share with a minimum commitment. Order volumes are not what we expected, not even half. We considered marketing ourselves better, but third-party aggregators ask for 50K to 1lakh a month for getting more clicks, it doesn’t work financially!“

He goes onto say, “We can consider pricing it lower considering the average ticket size in the market. But my ingredient costs are high that I will be selling at a loss”. His online pricing startsat 300 and goes up to 975, definitely on the higher end. Will online customers pay? He says, “It appears, we will have to introduce more affordable menu items to cater to online segment”. Most items are prepared in his Whitefield kitchens and then shipped to cloud locations, where final food is prepared and sent to customers. So one has to add the cost of transportation and labour too.

If you make everything at your cloud setup, you will need more manpower! Right now he has 3 people operating in his JP Nagar outlet, at 20-25K per person, you are looking at 60-75K per setup, that’s a 10-12.5% labour cost, assuming projected sales of 6 lakh a month. If you apportion mise en place cost and labour cost from their central kitchens, it ends up higher. Now, here’s a brand that’s very well known in Bangalore and it wasn’t an easy ride for them so far. He will experiment with this menu and pricing to see if order volumes pick up over the next couple of months.

Order value and daily orders

Typical order value (AOV) in a cloud kitchen will be in the range of INR 200-250. About 60-70% of orders will be in this range, a single person order. Zomato recently published a post that AOV has gone up.

- With AOV of 400, to make INR 6 lakhs a month, you need do 1500 orders a month or 50 orders a day.

- If we have 200 as AOV, double everything, i.e. 3000 orders a month and 100 per day.

The window is 12-2:30 for lunch and 7 to 10:30 for dinner, roughly 6 hours of active sales. A typical meal would take 7-8 minutes on an average to prepare. If we split 40:60 between lunch and dinner, the staff rotation and scheduling have to be planned accordingly. As order volume goes up, so might the need for more staff. One positive here is that labour increase will not be directly proportional to order volumes, up to a certain threshold. They are well trained to handle 100s per day individually.

Prasanna Kumar, CEO of Brew & Barbeque, Blr Brewing Co also ventured into cloud kitchens using Kitchens@ infrastructure. Though he’s used to working with Swiggy, Zomato for marketing, food delivery in his breweries, this was the first time he set up a pure delivery only kitchen. After 3 months of operations, he pulled out citing, “Tough to make money. Requires a lot of spend on marketing, continuously. Plus to get more orders, you either need to give a discount or pay to get promoted by third-party aggregators. What does it leave us with? “

When we asked about his views on the menu, pricing and labour arbitrage in the cloud vs running his brewery, he says “My labour expenses in Brew & Barbeque was about 16% on an average, running to 17/18% at times. In a cloud setup, it’s tough to get customers if the price is over 200. Plus having multiple cuisines creates more complexity and additional costs, in terms of sourcing plus labour. More cuisines, more skilled labour in each cuisine. Plus you need to have backups and account for shifts.“

When asked why he decided to pull out, “Wasn’t working out, bleeding money.” He adds,” Certain categories travel well, is easier and quicker to make, requires less labour. Am toying with a few concepts around Biryani to see if it works!”

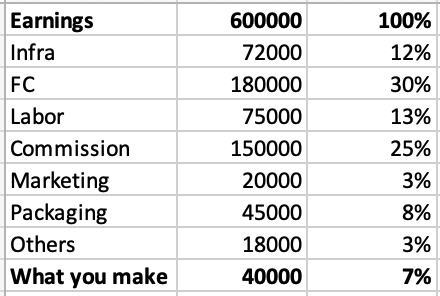

Prasanna shared his breakup of expenses whilst struggling with impoverished sales.

- Base price or minimum guarantee amount of INR 40,000.

- Then there is utility and other maintenance expense of about INR 30,000.

- Aggregator commission comes to 25% of sales.

- Then labour (3 staff), Chef visits once a week. About 60-70K

- Food cost – 30%

- Transport, packaging.

- Discounting and pay per click on platforms (which he didn’t opt for)

The minimum spend is either this (40+30) or 12% of overall revenue. Essentially, what this means is, if you do 6 lakhs, you will spend 72,000, which becomes the point where your minimum expense makes sense.

A typical sheet may look like this at 6 lakh revenue. Here we have assumed 25% commission as is the standard these days, no discounting and minimal marketing spend at 3%.

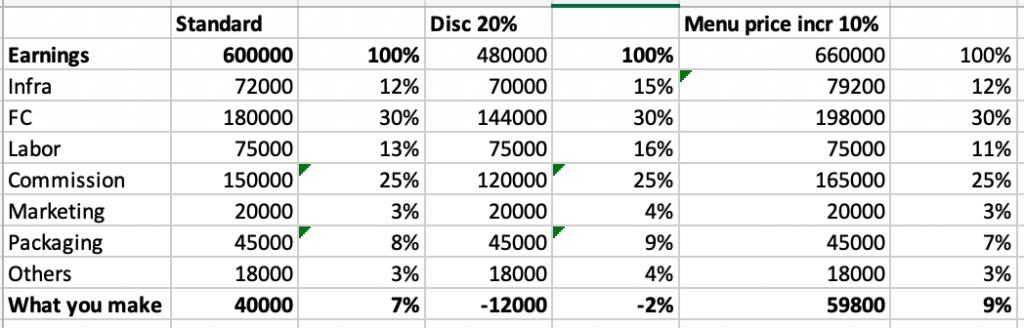

Let’s take a couple of use cases, with a 20% discount on MRP and a 10% increase for online-only listing, without discount to see what one can potentially make.

He categorically states, “Without discounting, you are unlikely to get orders. You will simply get lost in the crowd. The aggregators recommend you to provide a discount, but how long can one do that. I simply can’t. Furthermore, due to FOMO, most operators give discounts and customers tend to choose them.” He also added that interacting with different support staff for different needs left him ‘drained‘.

El Dorado:

Almost everyone is rushing to El Dorado in search of gold. It is a no brainer and established fact of life that delivery is picking up and will continue to grow. Unfortunately, there isn’t much of math behind this rush, there is no clear path to profitability. Marketing, discounting, commissions take a big bite of your revenue. Making margins in the food industry is like walking on thin ice. “You snooze, you lose”, says Ajay. He’s resorted to daily P/L for all his outlets to keep a close watch on numbers. There are brands chasing top line, there are some who sieve through the financials to see if it makes sense. For some, it may work out. But it is not a game for all, as is being touted by media.

“Your competitors are not your direct competitors, but the whole market” – Gagan Biyani, CEO of Sprig.

Special thanks to Ajay and Prasanna for sharing their experience and views with us about cloud kitchen profitability. In our next blog, we will cover a couple of big biryani chains and cloud kitchens in Bangalore to seek their view on financials and ways to succeed in this space.

Read more about our guide: How To Choose a Cloud Kitchen Software

Looking for a better way to manage costs? Click below to learn how EagleOwl solves all your cost management related problems for a seamless back-of-house experience.