“Opening a restaurant, writing a book and making a movie are arguably the top three things that humans desire in their life. Opening a restaurant is considered the easiest by most of them. Boy, aren’t they wrong!”–Vinodh Rajaraman

The quote stuck with me as it subtly explains that when it comes to restaurants, there is more supply than demand. Data shows that 60% restaurants fail within the first three years. Restaurant industry is crowded and the scope of even achieving a cost recovery or restaurant sustenance is rather slim.

Why is that, you may wonder?

It is mainly because the profit margin in F&B industry compared to other industries is rather paltry, with an average return of just about 5-6% in profit. Given such a stringent environment and tight rope walk, how does one expect to cross the hurdle of

- Recovering the initial costs (CapEx), and

- Generate additional profits.

During the initial set up of a restaurant, the costs can oscillate between being optimal to overblown depending on the choice of location, interiors, licensing, equipment & technology. But once the restaurant is set, what expenses would one incur on a daily or monthly basis?

It would be mainly the operational expenses like rent, utilities, labor costs, marketing, & food cost.

Rent, utilities & labor costs tend to stay constant month on month & the scope of saving on your bottom line may not be too much in these areas. These are fixed costs, irrespective of whether sales happen or not. Marketing costs too will vary depending on your need and budget. In fact you can choose not to have any marketing at all, provided you are confident of drawing footfalls.

Thus, in an operational restaurant, the only way to improve and maintain margins is through optimising food costs. The cost of goods sold generally is up to one-third of the restaurant’s revenue, a variable directly proportionate to your sales.

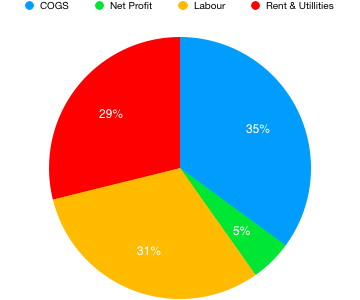

The below pie chart gives a breakdown of the percentage of costs involved in the restaurant operations (US market). Labor is roughly 33-35% in USA, leading to less profit, compared to India, where labor is cheaper and net profit can range between 12-15%

Restaurant operation costs

Food waste or pilferage alone costs considerable loss of revenue for restaurants. When you throw away food as wastage or if there is heavy pilferage in the kitchen, you are losing out on goods that could potentially turn into $$$. Restaurateurs are beginning to realise that effective inventory management and dynamic menu pricing are challenges that technology has not been able to fix completely. Many restaurateurs are still doing important task of calculating cost of goods and food cost percentage manually, using excel sheets.

Let us understand the basics of inventory management.

The most important aspects that needs to be tracked are:

- Sales

- Cost of goods sold

- Expected cost of goods sold

- Food cost percentage

- Expected food cost percentage

- OpEx

- Operating earnings/income.

Before we dig deeper into each of these aspects let us understand how I derived at that list. In order to make sense of where your restaurant stands in terms of the BOH (Back of House) operations, a basic P/L (profit & loss statement) i.e, before interest and income taxes is sufficient. This shows the operating earnings of the business.

Below is a sample of a mini P/L statement for restaurant.

| Sales Revenue | $ 26,000 |

| Cost of Goods Sold (COGS) | $ 14,300 |

| Gross Profit (Sales-COGS) | $ 11,700 |

| Operating Expenses (Opex) | $ 8,750 |

| Operating Earnings (Gross Profit-Opex) | $ 2,950 |

So we know that to derive the operating income or operating earnings we need Sales, COGS, & Opex numbers. Armed with this information, let’s explore all the aspects in detail.

1. Sales:

The sales or revenue generated by a restaurant in a given period is the cash inflow into the business by means the goods that were sold. This can also be sub categorised to each cost centre of a business like bar, food, beverages etc to understand the sales driven by each category. Here, net revenue should be considered, i.e gross sales minus discounts and complementaries (NC or Non-Chargeables).

2. Cost of Goods Sold (COGS):

Calculating cost of goods sold allows understanding of profit margins on each menu item and price the menu accordingly. It is also important in tracking the inventory and creating a P/L report.

COGS = Beginning inventory + Purchases – Ending inventory

3. Expected Cost of Goods Sold

It’s easy to calculate your actual cost of goods based on your inventory levels at the beginning and ending. This is what everybody is doing today. But to calculate your expected cost of goods you need to understand the cost price (how much it costs to make an item) and selling price (what is the price of the item it is sold at) of each of the menu item that result in sales.

Hence, expected COGS of a menu item= Cost of menu item x Number of items sold

For example, a restaurant selling only coffee;

Expected COGS to make 1 coffee = $2

Number of coffee’s sold= 20

Thus, expected COGS should be 2 x 20 = $40

Thus the expected cost of goods for a restaurant is the sum of cost price of each menu item multiplied by number of times each is sold.

4. Food Cost Percent

Food cost percent is something that is important for every restaurant to maintain. With the low profit margins of a restaurant, the only way to improve the margins is by maintaining a healthy food cost percent. Understanding this will allow you to use science & numbers in running a restaurant. An ideal food cost for restaurants is between 25-30% depending on the type of restaurant. Reducing food cost even by a single percent can mean profits in thousands of dollars for some restaurants. Here’s how you calculate that

Food cost percent = COGS/Sales

5. Expected food cost percentage

To know if your restaurant is doing a good food cost you need something to compare it with. For this it is essential to know the ideal food cost for each recipe or menu item which is sold.

Food cost percentage for each item is = Sum of the cost of the ingredients to make the item/ the revenue from the sale of the item

Using this formula an expected food cost can be computed for all the menu items that are sold for the day or the month. This value can be used to compare with your actual purchases made in the store or kitchen.

Let’s take example of the coffee store as above. Let’s suppose the cost price of a coffee is $2 and selling price is $8.

Thus, it is expected that food cost of a coffee = 2/8 = 0.25 or 25%

Let us analyse the consumption of one of the main ingredients of the coffee. According to the coffee recipe, we identify that each portion/cup requires milk worth $0.50.

Total coffees sold that day was 10 cups.

So we can estimate that if $0.50 milk is used in 1 cup, 10 cups of coffee sold must consume milk worth $0.50×10 = $5

But in the kitchen, the procurement data or the purchases made for that day for milk shows expense for $10. That is twice the expected consumption. The next day stock taking shows 0 amount of milk in the inventory. This means there is a loss of $5 worth of milk for that day.

This was an example for just one ingredient from one menu item. Extrapolate it to a restaurant with more than 100-200 dishes and thousands of ingredients. Keeping a track of inventory becomes a next-to-impossible task for the food controllers and chefs.

A good software is the only way out for this issue.

6. Operational Expenses:

Operating expenses include all expenses related to daily operations like rent, utilities, labour, marketing, licenses, maintenance, IT etc. Opex for most will amount to highest percent of costs involved in running restaurant followed by food costs. In US, labor is tracked separately, as indicated earlier.

7. Operating Earnings/ Income:

Calculating operating earnings for a business is important because it directly indicates the profitability or the efficiency of a restaurant. It’s always important to ensure that operating earnings increases as it is directly proportional to the profits.

Operating earnings = Revenue or Sales – (COGS + Opex)

It is not a surprise that many of the restaurant owners do not track these numbers as keenly as they should be and the ones who do… well, they aren’t repenting!

Learn more about our step by step guide how to build a restaurant operations manual.