If you want a chance at success in your restaurant venture, then restaurant budgeting should be one of your top priorities. Without proper restaurant budgeting, you might not realize that you’re already spending too much even before you open your restaurant.

What is Restaurant Budgeting?

Restaurant budgeting is a prediction made by the owners whether the restaurant will earn or lose money. It involves the use of high quality numbers and data. With the help of restaurant budgeting, owners and managers can make strategic decisions on their operations with the objective of maintaining a profitable business.

Who Should Be Involved with the Planning of a Restaurant’s Budget?

Top level management and staff should always be part of planning a restaurant’s budget. These are the people who know the restaurant costs and sales more than anyone else.

When we say top level management, this should mean the restaurant owner himself or if he’s not active, the general manager of the restaurant. On the other hand, staff that should be included in the restaurant budgeting plan is the operations manager, front of house manager, kitchen manager, and shift supervisors. Basically, we want all managerial level employees to be part of the planning.

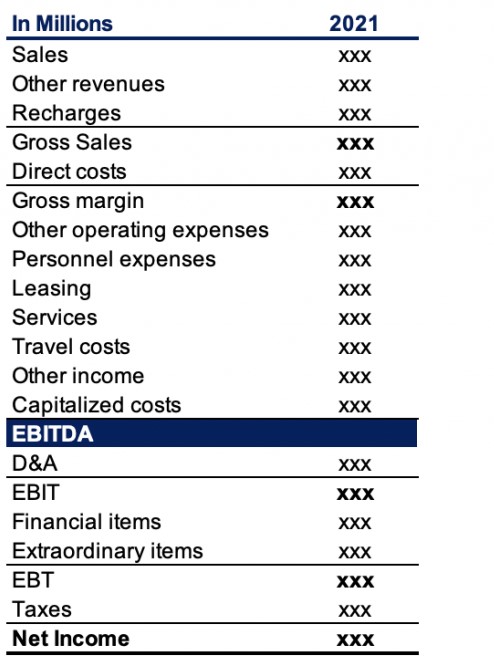

Actual vs Budget P & L

A P&L is usually filled up when your restaurant is already operating. What if your restaurant is still in the feasibility study phase? This is where the budget or pro forma P & L comes in.

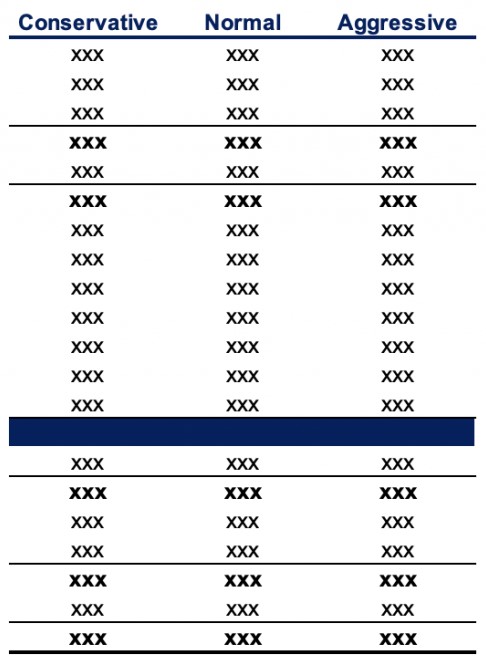

The numbers of your pro forma P & L will come from research and forecasts. Important line items such as sales, cost of goods sold, and labor cost should be forecasted in three different ways. First, a conservative forecast wherein you assume that your restaurant did not attract enough customers. Second, your expected forecast that entails your expected orders per day. Lastly, an aggressive forecast that surpasses your expectations and gives you the fastest return on investment.

By the time your restaurant is operating, you should be able to compare your actual profit & loss statement to the budget profit & loss you created before operations.

See an example of an Actual vs Budget P & L. The lines at the top will be the sales figures. Subtract your sales figures with direct costs and you’ll get your gross profit margin.

Next, calculate all your expenses and subtract it from your gross profit margin to get EBITDA – this means Earnings before Interest, Taxes, Depreciation & Amortization.

We will then subtract these items one by one to get your Net Income. Calculate the depreciation and amortization from your equipment and subtract to the EBITDA to get your EBIT. Proceed to subtract the EBIT to your interests and taxes to get your net income.

Ideal Time Frame for your Restaurant Budgeting

Budgets for restaurants are usually prepared annually. Once it has been set, the annual budget is less likely to be changed by the restaurant unless something drastic occurs. The annual budget is usually based on past sales and your expected year-on-year (YOY) growth and if you have multiple branches, same store growth sales (SSGS).

However, this is not an iron clad rule for all restaurants. In fact, some restaurants are so detailed that they are setting monthly and weekly budgets for their restaurants. This requires lots of planning as you’ll be creating the budget during Week 3 of the current month for a monthly budget and 3 days before the week ends for the weekly budget.

The purpose of restaurant budgeting with a shorter time frame is to have control over their costs. This way it would allow restaurant owners to see how their actual performance is doing against their budget.

Step-by-Step Guide on Restaurant Budgeting

After sharing some basics on restaurant budgeting above, it is time to show you how to do restaurant budgeting that really works.

Step 1: Record and Categorize Everything

The first step in creating your restaurant budget is to get all the necessary data. You need to implement ways to organize all types of revenue and expenses the restaurant makes. The most commonly used methods are a spreadsheet in Microsoft Excel or advanced accounting software.

The next step is to do category management on all your entries. We’ve broken down the most common entries into subcategories. See which lines fit your restaurant and add them to your tracking system.

Sales

- Food sales

- Beverage sales

- Liquor sales

- Bottled beer sales

- Draft beer sales

- Retail sales

- Event sales

Cost of Goods Sold

- Food cost

- Beverage cost

- Liquor cost

- Bottled beer cost

- Draft beer cost

- Retail cost

- Event cost

Cost of Labor

- Management team

- Entry level employees

- Labor benefits

Expenses

- Rental expense

- Security expense

- Utilities expense

- Royalties expense

- Marketing expense

- Insurance expense

- Permits and licenses expense

- Depreciation expense

Step 2: Keep Track of your Sales Numbers

As mentioned above, we have two ways of tracking the sales number of a restaurant. First, via restaurant budgeting and forecasting when the restaurant is still non-operational. Second, via tracking the history of your sales number from previous years to make an accurate projection.

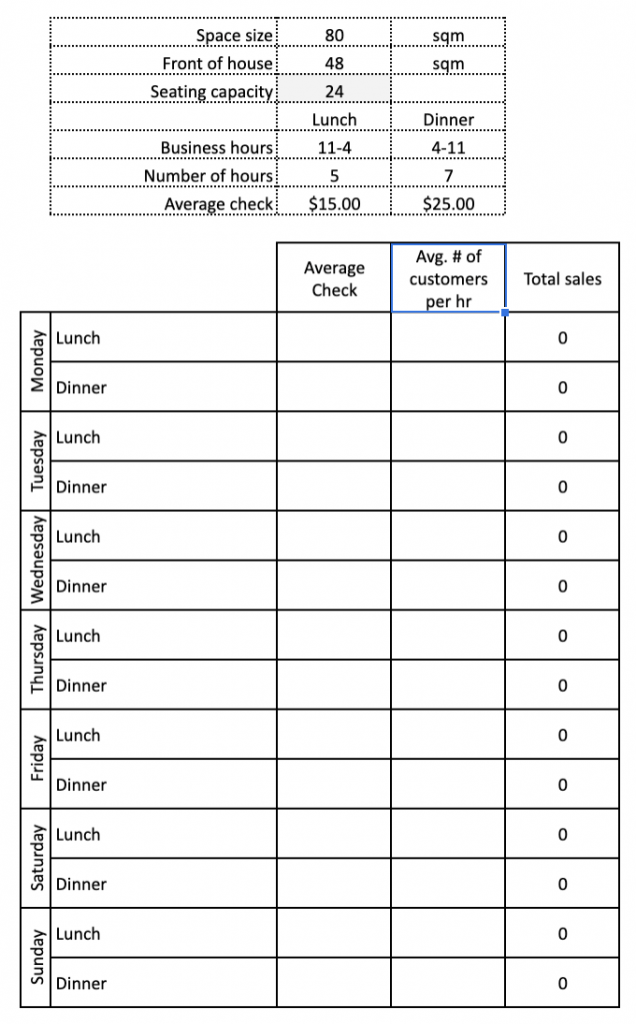

In order to make an accurate projection, try to use this calculator as a guide.

How to Use this Calculator

In this calculator, here are some of the assumptions made to get a forecasted weekly sales of a restaurant. First, you’ll need to get the total front of house space so you can calculate the maximum number of customers per hour. A safe assumption is one customer can occupy 2 sqm of space. So in this example, a 48 square meter front of house can seat around 24 people.

→Try this with EagleOwl software

Next, you’ll need to determine your operating hours and separate them into lunch and dinner. This will depend on the type of restaurant you own but for the sake of an example, let us assume that it’s a full service restaurant that offers different menus for lunch and dinner. If your restaurant serves breakfast, make sure to add a row per day named “Breakfast”. Count the number of hours you’ll serve breakfast, lunch, and dinner as you’ll be using this to forecast your weekly sales.

The next step is to calculate your average check amount. Separate these into three categories: mains, sides, and drinks. In the example above, let’s break down the $15 average check for lunch. You can get this by averaging the prices of your mains and sides: $11 for main and $4 for sides.

Lastly, you will need to assume the number of customers per hour that you’ll be serving. Use the maximum of 24 people as a baseline to calculate this. You can do the same thing we did the P & L above – create a column for conservative, expected, and aggressive.

For a conservative projection, use 50% of total seating capacity, 65% and 80% for expected and aggressive, respectively. Get your average customer per hour and multiply by the total number of hours you operate lunch or dinner.

Afterwards, multiply the total you get to the average check and you’ll get your total sales for the day. Do this until Sunday and multiply by 4.33 to get a monthly forecast. Note that we use 4.33 to get a more accurate monthly total because there’s 30-31 days to a month, multiplying by 4 will only yield in 28 days.

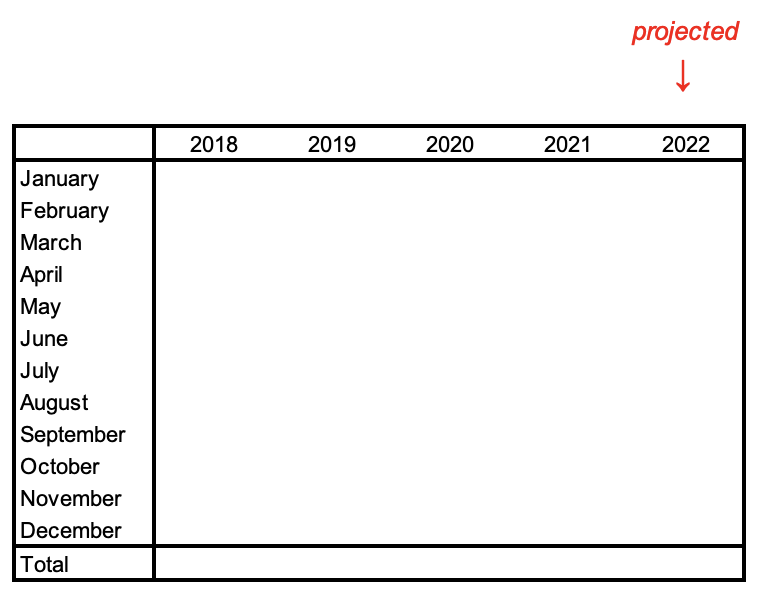

What If You’re an Existing Restaurant

If you’ve been operating for a certain period of time, it is most likely that you have data of your sales from the previous years. This is a good basis in projecting sales for the next year. Start off by listing down on a spreadsheet your total sales broken down into months. Then, depending on the number of years you’re operating, separate them into columns. See a blank chart below.

In the restaurant business, not all months will have the same revenue. There are months in the year where it’s peaking while there’s also months where it’s very lean. Use these historical data to your advantage and provide a good projection for the next year. For example, your restaurant usually does well during the summer (mid June to mid September in the USA). Make sure to take this into account when putting up a projected sales number.

Step 3: List Down All Expenses

As we’ve mentioned in step 1, listing down all your expenses and categorizing them can help you prepare in restaurant budgeting. Fixed expenses, like rent, are costs that you cannot change. On the other hand, variable expenses are costs that you can set a budget on.

Electricity and water are two expenses that a restaurant can save expenses on. Try to set a budget that’s reasonable to achieve for the team. In addition, maintenance and repairs are sort of an added cost for the restaurant. Try to set strict rules in taking care of equipment, accessories and other smallwares to limit this type of expense.

The expenses file should always be updated every end of day. This is to ensure that you don’t miss anything. In addition, this file also serves as the file that you can send to accountants for filing tax returns.

Step 4: Conduct a Sales vs. Cost Analysis

It is now time to put it all together. Conducting an analysis on both your sales and costs will give you an idea on how your restaurant is faring. For example, if you see your sales at $200,000 and your total expenses at $150,000. What do you think this means? It means your restaurant is healthy enough that it’s earning $50,000. On the other hand, if your sales are at $200,000 and your total expenses are at $250,000, changes might have to be made with your restaurant. Because if this keeps up, the days of the restaurant might be numbered.

Step 5: Don’t Be Afraid to Make Drastic Changes

Once the restaurant’s expenses have surpassed its sales, it might be time to revisit some things in the restaurant.

The most common culprit is the high cost of goods sold. Study and research all possible ingredients that you can use for your menu with the goal of minimizing food costs. Aside from a high COGS, a high number of employees can also be a problem. A bigger problem is if these employees are unproductive and offer poor customer service. These will turn your customers off and might not give an opportunity for them to come back. In short, make sure you hire the right staff so avoid having the poor customer service label.

Another reason is that sales simply might not be enough. This means you have to be aggressive in marketing your restaurant. You can use digital marketing tactics with the help of Instagram marketing to bring more customers to the restaurant. In addition, it is always good to offer coupons to customers to make them come back again and again.

Step 6: Choose the right restaurant budget template

Though seems like restaurant budgeting is a one topic, in reality there are different templates for different cases. Here is a list by SampleForms that will help you find a free downloadabale restaurant budget template for the most important cases:

- Restaurant Budget Template

- Restaurant Business Profit and Loss Template

- Restaurant Event Budget Proposal Template

- Restaurant Marketing Budget Template

- Restaurant Start-Up Costing Budget Template

How to make annual budget for restaurant

Having a realistic budget is crucial to control your restaurant’s expenses. An annual budget is a plan or blueprint for the upcoming year that will help your restaurant stay profitable. It is created keeping in mind your past sales record and your goals for the upcoming future.

A major problem faced while preparing budgets is lack of anticipation of changes in the operational environment. These could be consumer behavior, new trends and foreign factors. While some of these changes could be controllable others could go totally out of hand. A proactive planner must take steps to avoid any extraordinary deviation from the budget and minimize any delta occurring due to such changes.

If you are struggling with how to make annual budget for restaurant, start by recording all your yearly expenses. This needs to include all the fixed expenses as well as a forecast of variable/seasonal expenses. For instance, you will need extra cooling equipment to retain freshness of certain raw materials during summers. This comes under seasonal expenses.

As opposed to a monthly/quarterly budget, an annual budget for a restaurant needs to have room for unprecedented expenses. For instance, COVID-19 took over the world in 2020 causing restaurants to shut operations indefinitely. Such changes cannot be accounted for beforehand but can shake up your annual budget. So now for the next few years, restaurants need to keep in mind that a new variant can cause similar issues.

Another crucial element to include is capital expenditures which have a heavy impact on the cash flow. Capital expenditures are basically long-term investments. For instance, freezers and refrigeration units for storing perishable food items are a necessity for every restaurant. Examine all such capital expenditures that you will need to make.

Next, use your previous year’s sales data to create a projection for the upcoming year. This projection needs to be both practical (looking at your current business revenue) and aspirational (the revenue you want from your restaurant in the coming year). Don’t forget to factor in the year on year growth witnessed by your restaurant business.

Once you have all the intel, do an analysis of how this measures against your set priorities. Let’s consider your restaurant is making 1 million annually. And your goal is to turn it into a 2.5 million business by the end of next financial year. Keeping this goal in mind will help you put spending caps and allow you to allocate funds in a way that helps you meet this goal.

Restaurant budgeting software: Why do you need it

The most important reason for choosing a restaurant budgeting software is automation. Restaurant budgeting is tedious and complicated and can be very time-consuming if done manually. Moreover, it can get very challenging to keep track of every expense and sale that your restaurant makes.

A restaurant budgeting software helps in categorizing your income and expenses, making it easy to understand where your money is going. It gives meaningful insights about your spending patterns and highlights red flags. This allows you to discover areas of improvement and opportunities of reducing costs.

By investing in a restaurant budgeting system, you can track your expenses and sales in real time. Having an accurate record in the software will help you make informed financial decisions for your restaurant business. It also helps you digitize invoices and track inventory which reduces any chances of discrepancy.

How our Restaurant Management System Can Help in Restaurant Budgeting

With the grind of everyday operations in a restaurant, automating a bunch of things will go a long way in making life easier for you. First, EagleOwl can make inventory easier for your restaurant. The software will automatically compute stock level and value and will provide you with variance reports. In addition, the software features an SKU price trend for the restaurant to see when prices of a certain ingredient is high or low.

Second, EagleOwl will automate the costing of all the recipes in your menu. It will alert you if the software believes that the cost for a certain product is too high. In conjunction with automating your menu, the software also conducts menu engineering on your products. The software will also perform the menu engineering matrix on your menu and will identify your stars, horses, puzzles, and dogs.

Lastly, EagleOwl will help with all supply chain management responsibilities of your restaurant. All your purchases will be under one roof so you can backtrack on previous orders. There is an order automation feature so you won’t second-guess the amount you need for your next order.

Final Thoughts

For your restaurant to be successful, all financials must be tracked down to the last centavo. This is where restaurant budgeting plays a huge role.

Do not wait until your finances are crumbling before planning for a restaurant budget. Be proactive so you can avoid future headaches. Your annual budget will never be the same every year. You have to make sure that you conduct your due diligence on your historical financials and sales forecasting.

Learn how to grow with EagleOwl. Our restaurant management system can help optimize your finances and increase your restaurant’s net profit by at least 25%. Contact us now to schedule a free demo!