Okay, where do we start? Swiggy is all over the news, the blue-eyed boys of the food delivery ecosystem, clocking close to 3.5 million orders a month and inching to 4MN a month. Now, that’s some big numbers. Last week there was a blog — House of Cards by current/former employees of Swiggy and a quick rebuttal from Harsha Majety.

The Business:-

Everyone knows their revenue streams, there isn’t much to elaborate. Firstly, this is one hell of a tough business to execute. There are too many moving parts in this operations intensive field. The fact that they have touched (if they have) so many orders across 8/9 cities in India in about 3 years places them in a very good spot. It is easy to criticise looking from outside, but one has to admire them for sitting on the perch.

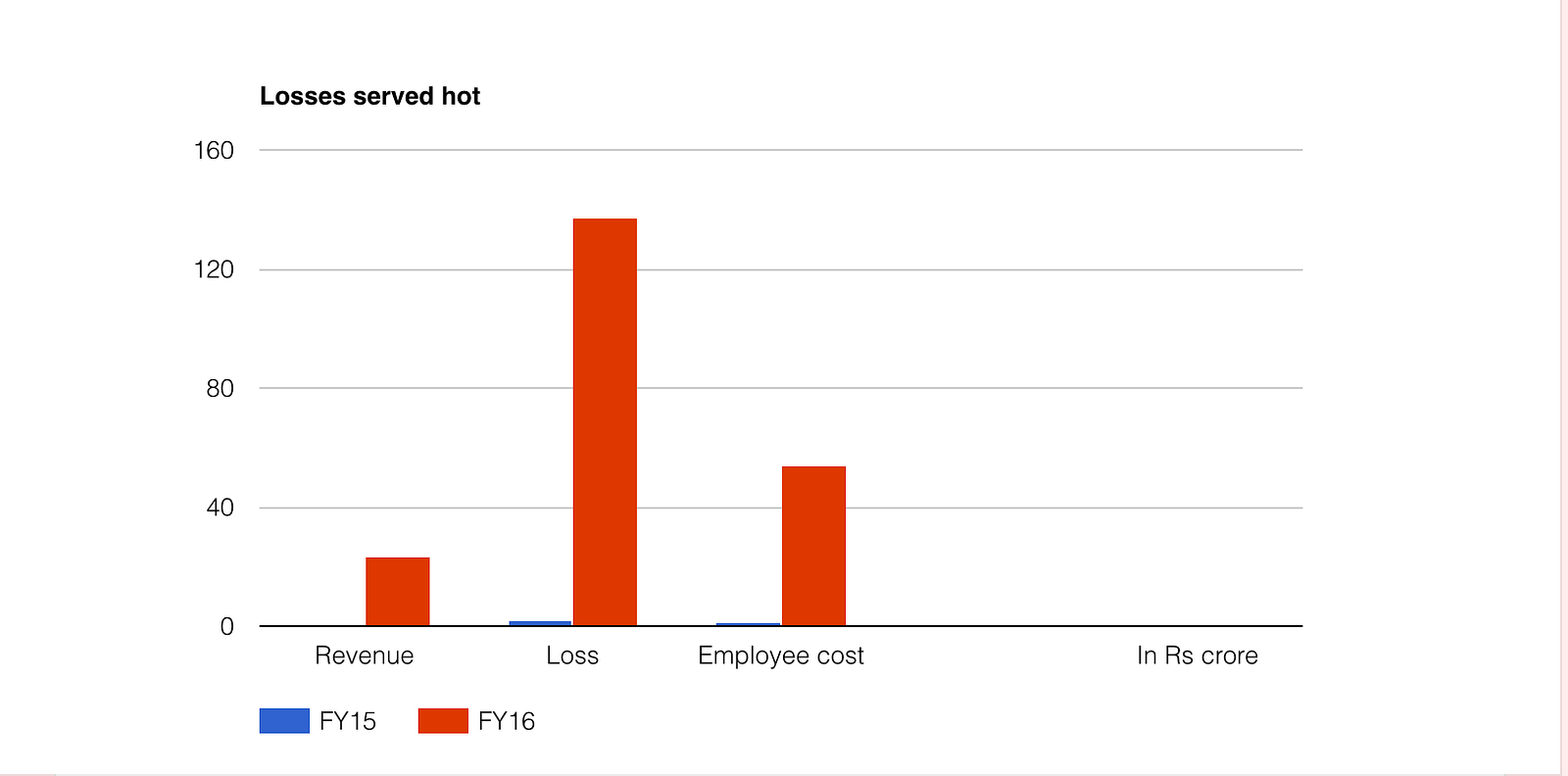

Analysis of Fy15–16:-

Every company has to file their returns which are available online for a nominal fee from MCA website. This tells a bit more than what we normally read in the media. As a matter of fact, you are cautioned to not believe everything in media, quite a good percentage are, well — lies, damned lies and statistics.

The Ken, a Bangalore based news startup scores better here, they try very hard to get actual numbers. Last November, they published this piece on Swiggy.

Source: The-Ken.com

Let us have a quick recap of key numbers.

- 3000 delivery boys — April 2016

- 1 million order a month in April 2016

- Average order value of 300 (assumption plus live mint report)

- Income ~ 20.01 Cr (from commissions, delivery charges)

- Employee cost ~ 54 Cr

- Delivery cost ~ 44 Cr

- Cancellation loss ~ 2.7 Cr (6% of delivery cost or 16% of commission revenue)

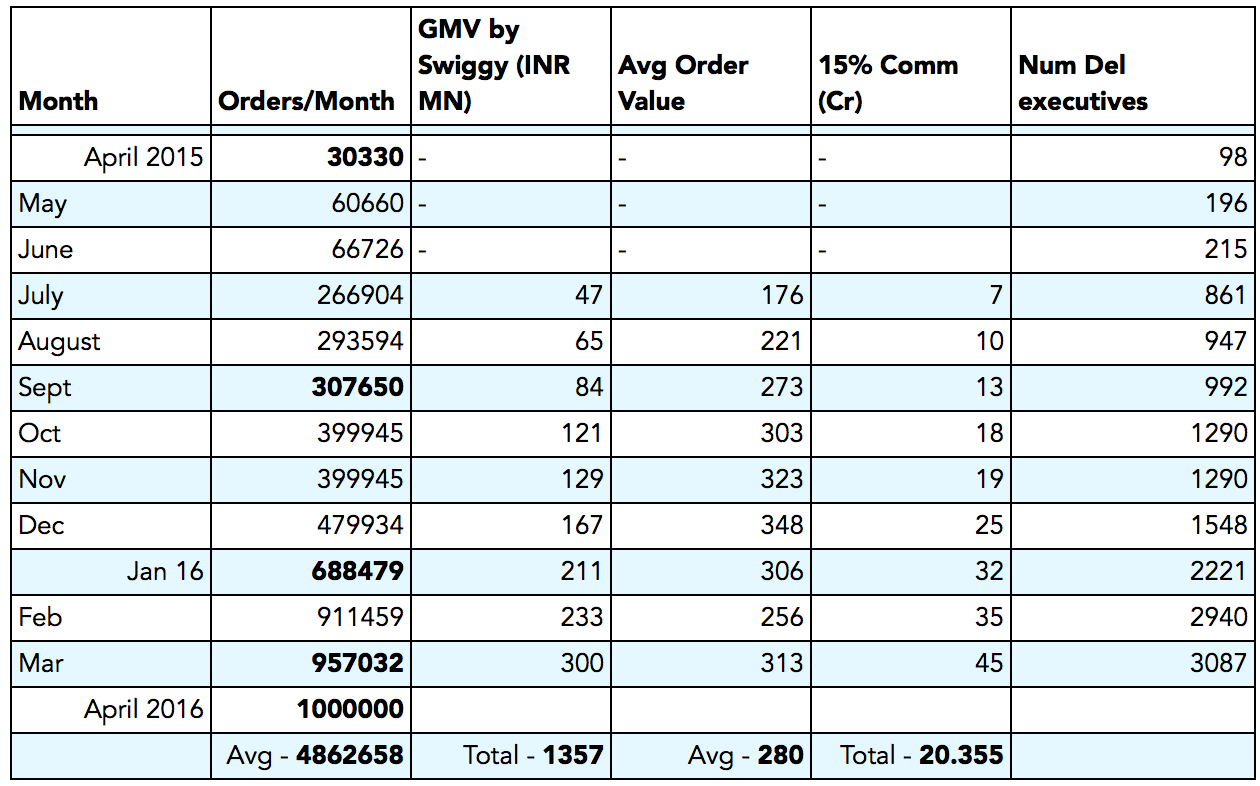

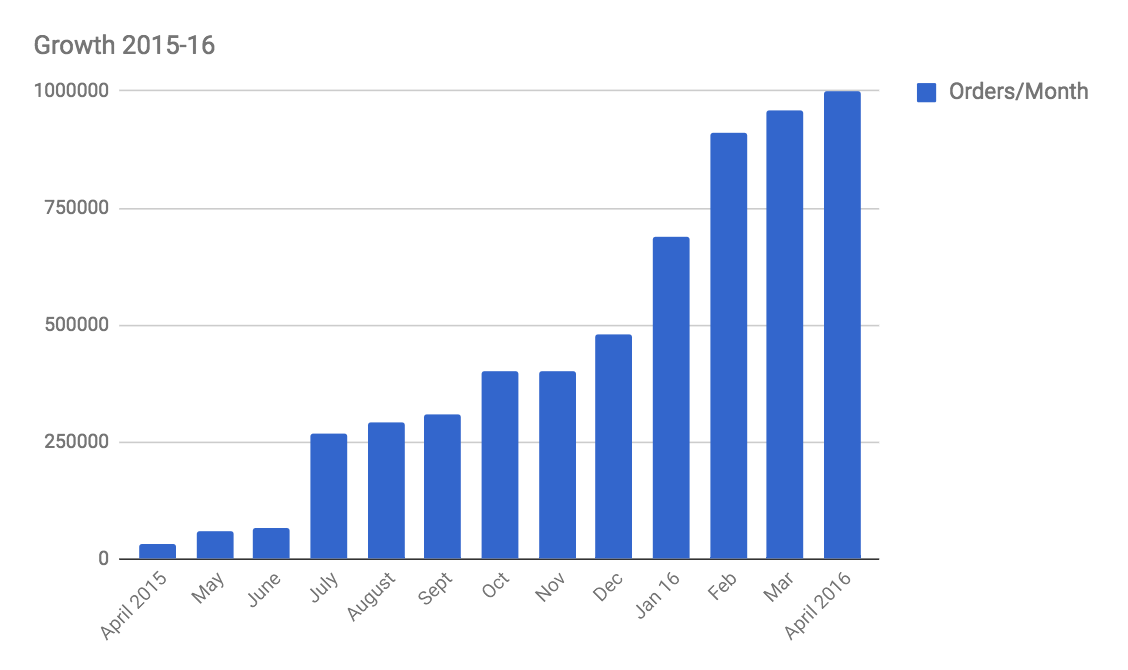

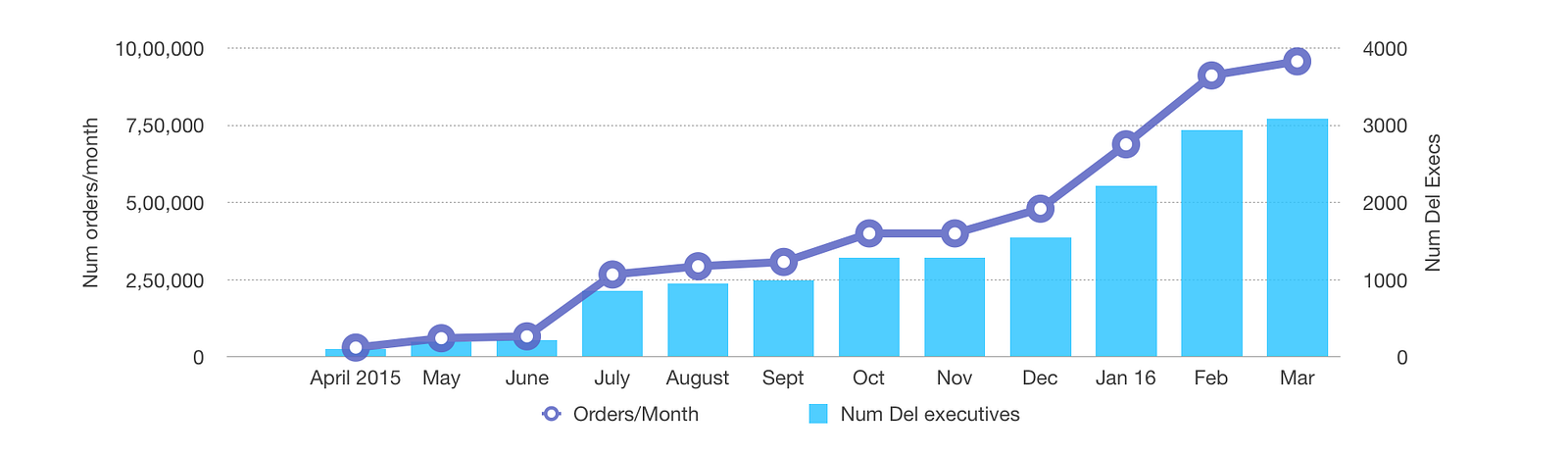

Let us take a look at the data from the whistleblowers’ blog (also confirmed by CEO Harsha) and backtrack to above numbers. The base number of 1011 for April’15 and 1 Mn orders for April’16 were also quoted in media. The-Ken and yourstory.com reported 3000 as number of delivery boys whereas another portal reported 4200 in April’16. Number of 3000 sounds more reasonable, I have assumed an average of 10 deliveries per day for each executive which is easily doable.

I spoke to couple of my friends (one in Whitefield, another operating in HSR) who are delivery executives in Swiggy last week. They confirmed that one can easily do about 15–17 per day. Why then choose 10 as average number of deliveries/day ? Because if that’s the case, they wouldn’t have had more than 2200–2300 odd delivery executives in March/April’16 but that doesn’t seem to be the case based on news reports.

Caveat

- The highlighted orders/month were taken from their own blog. Other numbers were filled based on eye-ball measure of bar height of each month and applying the growth rate for each month over the previous month. This roughly matches what they have showed in their presentation but inaccuracies may still exist. Saving grace is that if am wrong, someone will clarify.

- The chart was a bit blurry and bar height too small that i couldn’t exactly figure out exact GMV for first few months. It is however insignificant and can be discarded.

- Since total revenue had to be around 20 Cr, numbers (for e.g. commission percentage) are worked backwards.

- 15% average commission is quite plausible. They started low and increased over time to 20% sometime towards latter half of 2015. 20% is unlikely as their revenue would then have to be close to 27.14 Cr

- Already explained delivery executive number calculation — taking a punt.

Okay, so we have had a look at the charts. What do we make of it ?

- ~15% take-rate (as they called it in presentation) sounds reasonable/acceptable.

- If there indeed were 3000 delivery partners — they did ~10 deliveries/day and not more. This looks a lot lower by industry standards, but not totally unbelievable.

- Do you remember the 44 Cr delivery cost ? At an average of 4.05 lakh orders a month, it leads to a cost Rs.90.5/order. The industry average is around Rs. 50–60. No brownies for Swiggy here.

- If Swiggy had delivered at even Rs.65/order — they would have saved a good INR 12.4 Cr — i.e spent 31.6 Cr instead of 44 Cr.

- Spectacular growth rate in orders/month — CAGR of 33.8% till Apr’16. Four fold jump from June to July (Zomato — can you share your data for same period ?). Significant growth of around 43% in Jan.

What they said vs reality ?

- Majety said the company touched 1 million orders in April 2016, and expects to do 100,000 orders a day in two months — approximately triple of what was seen in April — in reality this is likely to have happened only in May/June 2017. A full 1 year later than anticipated. Happens.

- The whistle blowers’ said there is no insurance for delivery executives — this doesn’t seem to be true. They indeed have provided accident and health insurance (as told to me).

- The same person mentioned that whilst he gets paid Rs. 40 per delivery in HSR, Swiggy also engages personnel without driving license at Rs. 30 per delivery — if this is true — this is an ingenious way to bring down delivery cost !

- Harsha said about Bowl company — “Opening up in areas where there is a poor supply of restaurants”. For those of you who don’t know Koramangala, this is okay. For others — well a ruse or a joke.

We have missed the 54 Cr expense on employees. I have no idea how many employees they had in Fy 15–16. As of today, they have 1600 odd employees on LinkedIn. When I checked last Nov/Dec or so, it was around 1142. Am guessing they would have had around 500–600 employees — so a rough expense of 10 lacs per annum.

News from underworld — The B Company

- Spoke to 4 different restaurant owners — every one of them seemed angry with Swiggy for various reasons and mentioned that they would opt out soon. When asked for alternative, it was “Runnr”.

- One restaurant owner even lamented, “Harsha and Nandan used to wait an hour for my appointment” — well times have changed. He also mentioned that many of association members feel Swiggy is unethical, courtesy “The Bowl Company”.

- Another mentioned that he may consider filing a case for using their data to gain unfair advantage — again The Bowl company. Wrath everywhere.

- Zomato has shown maturity by aligning with restaurants — wherea Swiggy has taken a different route, at least for now.

In Part 2 we will go through FY16–17 numbers presented in the investor deck. If 4 million orders are true, the game could change quite soon and we will see why.

Comments are closed.